22+ montana paycheck calculator

Just enter the wages tax withholdings and. The state income tax rate in Montana is progressive and ranges from 1 to 675 while federal income tax rates range from 10 to 37 depending on your income.

Montana Salary Paycheck Calculator Gusto

Well do the math for youall you need to do is enter.

. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Montana. No personal information is collected. Number of atoms calculator.

The Montana Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Montana State. This tool has been available since 2006 and is visited by over 12000. Montana Paycheck Calculator Use ADPs Montana Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Montana Income Tax Calculator 2021. Figure out your filing status work out your adjusted gross income. Ti34 multi view calculator.

SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Simply enter their federal and state W-4 information as. The state tax year is also 12 months but it differs from state to state.

Calculating your Montana state income tax is similar to the steps we listed on our Federal paycheck calculator. Your average tax rate is 1198 and your marginal tax rate is. As an employer in Montana you have to pay unemployment compensation to the state.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Montana Montana Salary Paycheck Calculator Change state Calculate your Montana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal. Some states follow the federal tax year some.

The 2022 rates range from 1 to 675 on the first 35300 in wages paid to each. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Montana. If you make 70000 a year living in the region of Montana USA you will be taxed 12710.

Enter your info to see your take home pay. Our paycheck calculator is a free on-line service and is available to everyone. Montana Montana Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and.

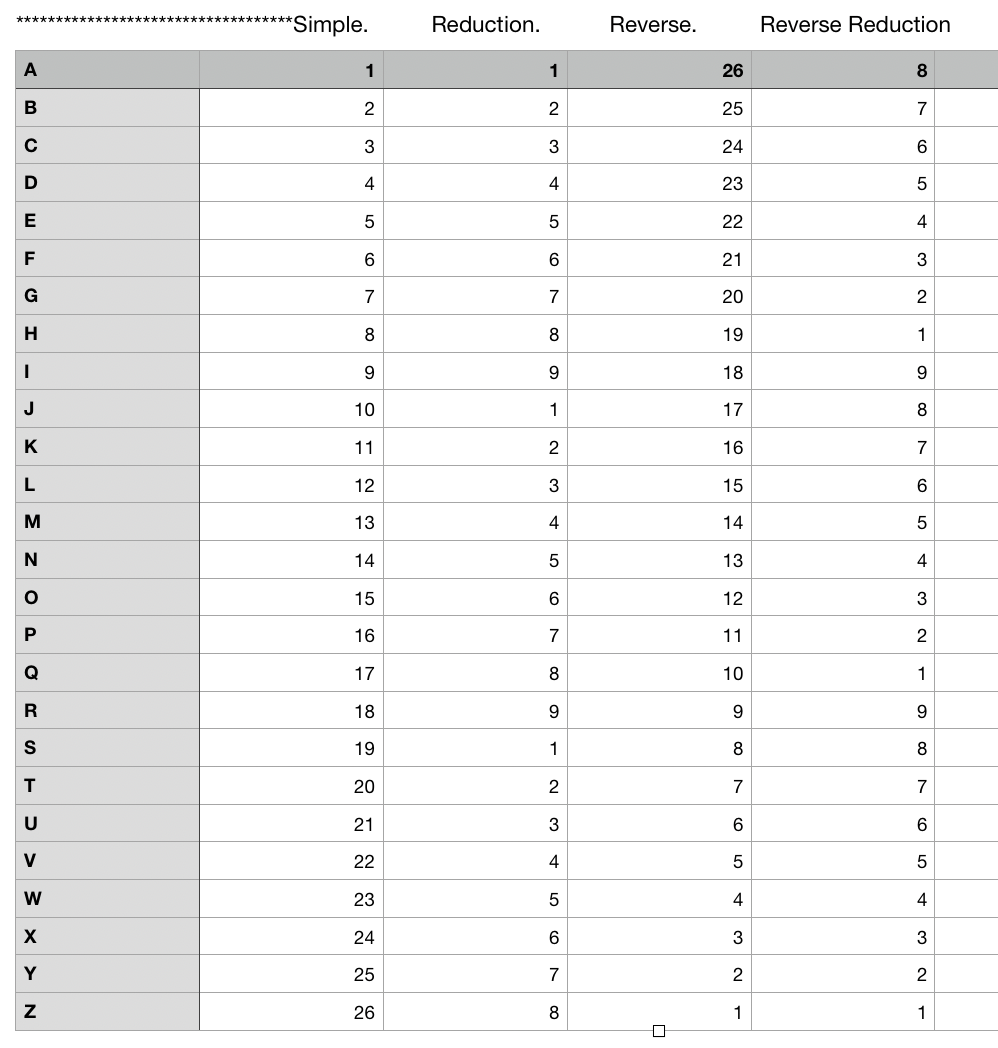

Numbers And The World

Florida Food Stamps Eligibility Guide Food Stamps Ebt

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Pdf 2015 Risp Web 2 Pdf Sheryl A Larson Academia Edu

Paycheck Calculator Salaried Employees Primepay

Montana Salary Paycheck Calculator Gusto

Paycheck Calculator And Salary Calculator Employment Laws Com

Free Paycheck Calculator Hourly Salary Usa Dremployee

Free Online Paycheck Calculator Calculate Take Home Pay 2022

G778270dsp18b Jpg

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Paycheck Calculator Take Home Pay Calculator

Pdf Prion Diseases Neuromethods 129 Salvador Eduardo Acevedo Monroy Academia Edu

Ibuyer Reviews Rankings Pros Cons And Alternatives

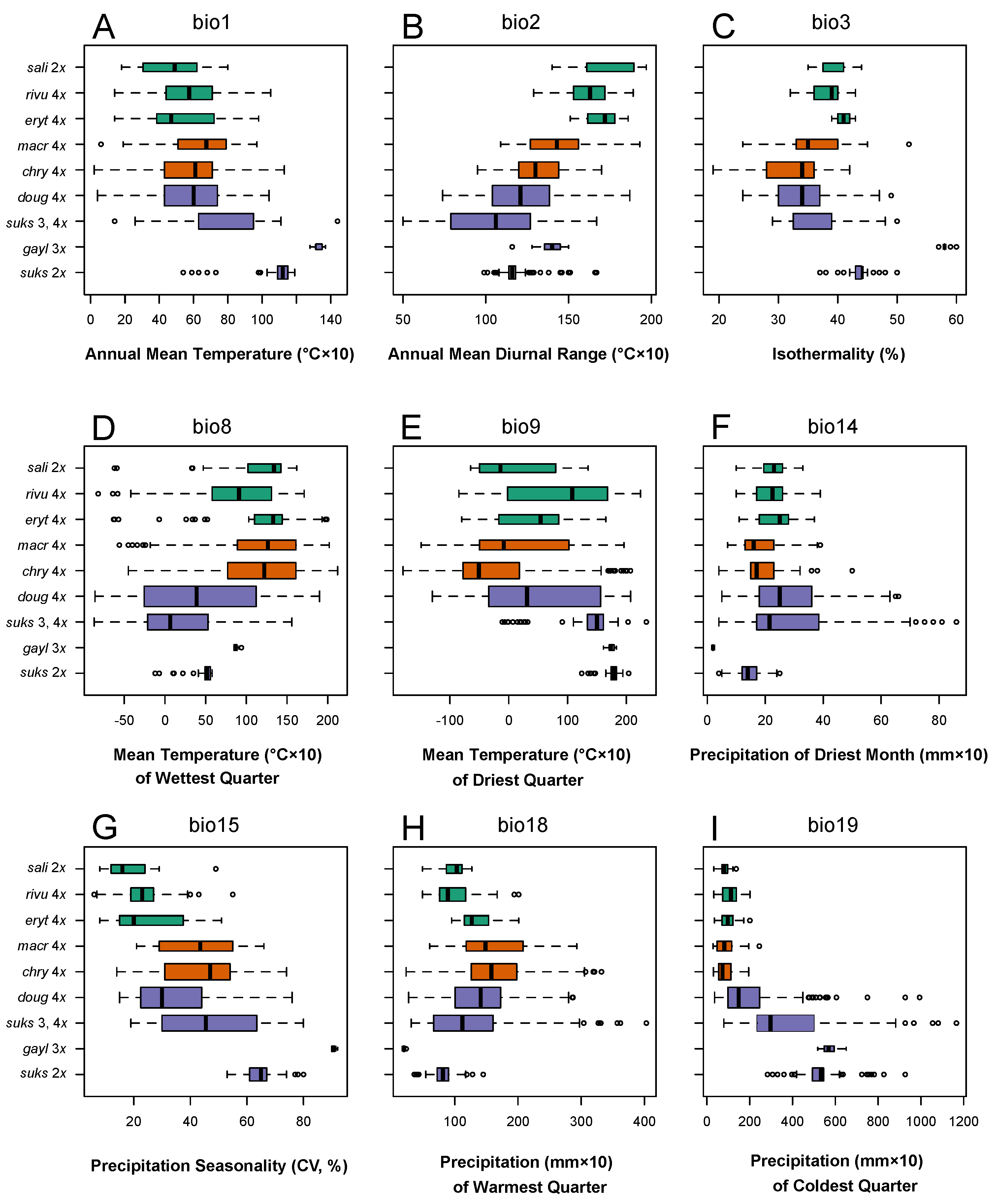

Agronomy Free Full Text Niche Shifts Hybridization Polyploidy And Geographic Parthenogenesis In Western North American Hawthorns Crataegus Subg Sanguineae Rosaceae Html

New Tax Law Take Home Pay Calculator For 75 000 Salary

Paycheck Calculator Take Home Pay Calculator